AMTA Members

+

Gold Capital Financial Services + Alberta Motor Transport Association

Working together to make you stronger

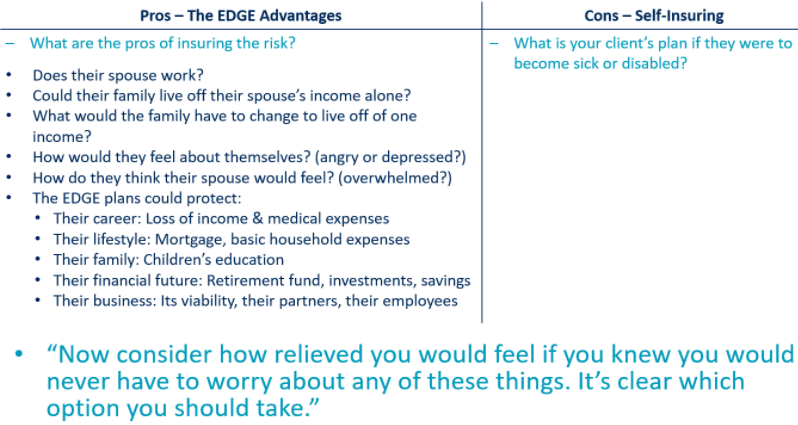

Personal insurance provides peace of mind and an affordable safety net to prevent significant financial hardship from a sudden medical event. There are many types of personal insurance; health and dental benefits provide immediate reimbursement for out-of-pocket medical expenses not covered by government plans, while other types of coverage include income replacement due to a disability or protection against specific risks that are highest during your working years. Each type of coverage serves a specific role in a well-balanced financial plan. Whether you are enrolled in a group benefits plan through work, or are one of the 33% of Canadians who are self-employed, having a personal benefit plan is vital to ensuring your finances are adequately protected. Employer-sponsored benefit plans vary greatly, often providing only a basic level of protection, and only cover you while you remain with that employer. Similarly, WSIB and WCB only protect against workplace accidents, yet statistics show that most accidents actually occur off-hours and illness and disease are six times more likely to be the cause of disability than accidents. Qualifying for workplace compensation can be difficult, and as much as 50% of claims are rejected by these plans.

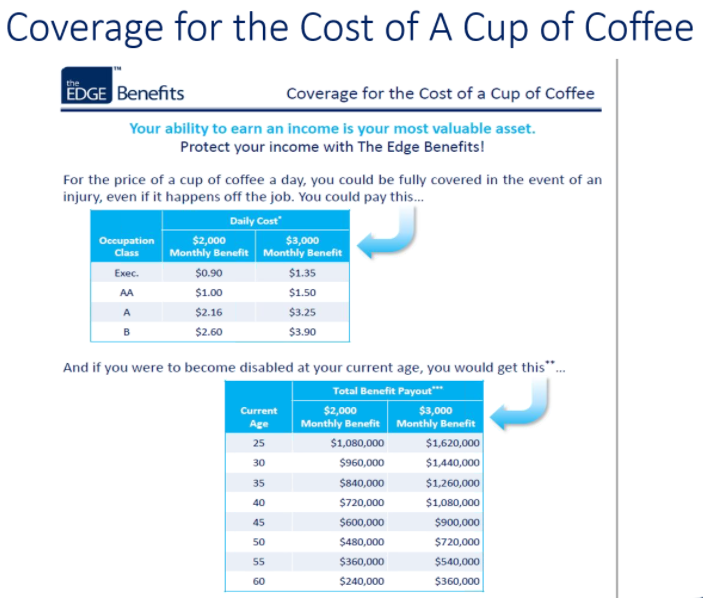

Every working Canadian needs benefits to protect their earning power, lifestyle and loved ones. In your working years, you’re more likely to have dependents and financial obligations (like mortgages and car payments) that you wouldn’t be able to meet if unable to work. Everyone should consider protecting themselves against loss of income or medical emergencies, and premiums are often less when you’re young and healthy. Consider your stage of life as well as how living benefits are paid out to determine the best plan for your needs

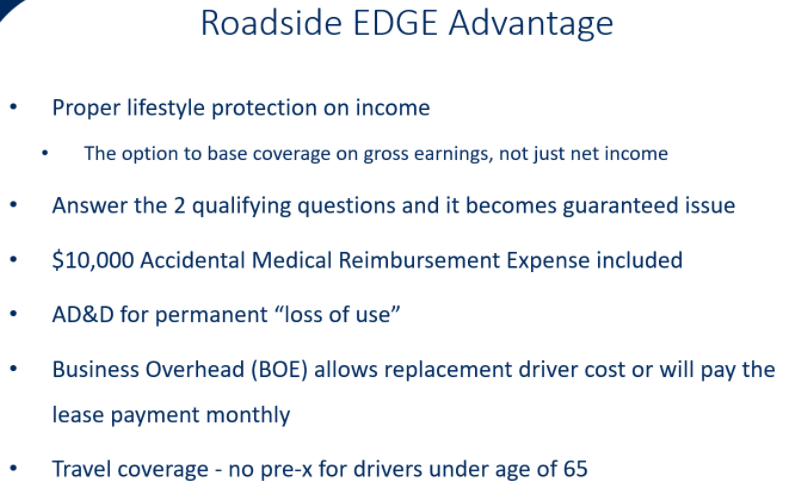

A farmer once told me that his crop insurance costs 10% of his crop. Accident and Sickness coverage costs far less to cover him if he was unable to work. This allows hiring someone to do the job for them while the body can heal. This is the same for any self-employed owner.

DID YOU KNOW

When this happens and you cannot work What will you do for you and your family or business?